Basic Approach

The Maruha Nichiro Group has a history rooted in the sea and spanning over 140 years. Precious natural resources and the natural life force of the sea have supported our growth.

With the increase in the world's population and the economic development of emerging countries, the demand for fish consumption is expected to increase in the future. In order to meet demands and protect marine resources, we will continue to contribute to the creation of a sustainable global environment and society through our business activities.

Summary of Progress in FY2024

The previous medium-term management plan (FY2022–FY2024) generally progressed as planned, and in relation to the Maruha Nichiro Group Marine Products Procurement Policy formulated in September 2024, “establishment of electronic traceability methods” was newly set as a KPI in the new medium-term management plan from FY2025.

Results of the Previous Medium-Term Management Plan (FY2022–2024)

Materiality: Action for preserving biodiversity and ecosystem

KGI (the figure which wants to have 2030): Confirm that there is no risk of resource depletion in the fish stocks we handle

Responsibility Department: Maruha Nichiro Sustainability Department (former Corporate Planning Department sustainability group)

| KPI | Target | Self-evaluation and problem of the prometaphase management plan | ||

|---|---|---|---|---|

| The aim year | Target value | Progress result comment | Self-evaluation | |

| Resource status confirmation rate of handled seafood products (Overall G) | 2030 | 100% | Conducted the second marine product resource survey in FY2022. Confirmation rate of resource status of marine products handled: 81.8%. | ★★★☆☆ |

| Conduct biodiversity risk assessment (Domestic G) | 2024 | - | Conduct biodiversity risk assessment based on TNFD framework | ★★★☆☆ |

| Implementation of certification level management for aquaculture farms (Domestic G) | 2024 | - | Implementation of certification level management of aquaculture farms (domestic group) in accordance with voluntary management standards. | ★★★☆☆ |

★★★★★ : KPI for FY2030 achieved.

★★★★☆ : Progress toward achieving KPI for FY2030 in advance.

★★★☆☆ : KPI for FY2024 achieved or progress toward achieving KPI for FY2030 as planned.

★★☆☆☆ : KPI delayed.

Medium-Term Management Plan (FY2025–2027) KGI, KPI

Materiality: Action for preserving biodiversity and ecosystem

KGI (the figure which wants to have 2030): Confirmation that there is no risk of depletion of the marine resources handled

Responsibility Department: Maruha Nichiro Sustainability Department (former Corporate Planning Department sustainability group)

| KPI | Target | |

|---|---|---|

| 2027 | 2030 | |

| Resource status confirmation rate of handled seafood products (Overall G) | Development of policy for handling evaluation "Not scored" | 100% |

| Establish an electronic traceability method | Started working on some fish species | ー |

| Conduct biodiversity risk assessment based on the TNFD framework (Domestic G) | Expanded TNFD-based scenario analysis | - |

| Implementation of certification level management for aquaculture farms (Domestic G) | Establishment of management system at all aquaculture farms in the group | - |

Main Initiatives

Overview of the Second Marine Resources Survey

We launched a marine resources survey from 2019, and in FY 2021, we conducted the second marine resource survey targeting raw materials and products procured from outside our Group in FY2021. We will continue conducting this survey with the aim of realizing our ideal state in 2030, based on our belief that monitoring the state of marine resources handled in our business activities will help us recognize issues and make improvements to preserve biodiversity and ecosystems.

Survey Objective

- To gain an overall picture of the marine products handled by the Maruha Nichiro Group (fish species, area, quantity, etc.)

- Assessment of resource status and management of natural marine products handled

- Identification of issues and consideration of countermeasures to achieve KGI

Survey Method

| FY of implementation | First (FY2020) | Second (FY2022) |

|---|---|---|

| Target FY | FY2019 | FY2021*¹ |

| Survey scope | 48 Group companies (31 in domestic, 17 overseas) | 42 Group companies (25 in domestic, 17 overseas) |

| Analysis agency / Reference data | SFP*²/FishSource*³ | SFP/FishSource |

| Evaluation method | Our proprietary criteria | Criteria of ODP*⁴ methodologies |

| Evaluation criteria | (1) Healthy The five FishSource scores average 6 or higher, and score 4 is 6 or higher (2) Not healthy The five FishSource scores average less than 6, or score 4 is less than 6 (3) Date deficient If there are missing items for the five FishSource scores and evaluation cannot be performed | (1) Well managed The five FishSource scores are all 8 or higher (2) Managed The five FishSource scores are all 6 or higher (3) Needs improvement If there is a score less than 6 for the five FishSource scores (4) Not scored If there are missing items for the five FishSource scores and evaluation cannot be performed |

- *1

- April 2021-March 2022 for domestic and some overseas companies; January2021-December 2021 for other overseas companies

- *2

- Sustainable Fisheries Partnership. The US NPO which manages FishSource.*3

- *3

- An international marine resources database developed based on marine resourcesinformation from the administrative agencies of various countries.

- *4

- Ocean Disclosure Project. An information disclosure platform aimed at enhancingthe transparency of marine product procurement, managed by the SFP.

Survey Results

Marine Products Overall

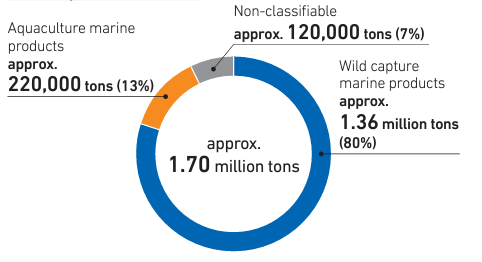

In FY2021, the Group as a whole handled approximately 1.7 million tons of raw fish equivalent, and in terms of scientific name, handled 337 species of wild fish and 83 species of farmed fish. On the other hand, the amount of non-classifiable was approx. 120,000 tons, mainly from raw materials for feed, and while this is an improvement from 140,000 tons at the time of the previous survey, we recognize that it is still a major issue.

Wild Capture Marine Products

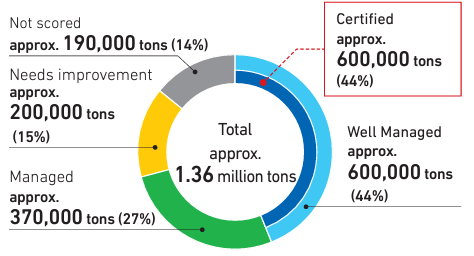

In order to evaluate the resource status and management status of wild capture marine, we conducted an analysis based on the SFP’s ODP methodology. As a result, we found that among wild capture marine handled by Maruha Nichiro Group, 44%, or about 600,000 tons, was evaluated as “Well managed,” and of this, most of this, were mainly Alaska pollock and other similar species caught by fishery businesses certified as sustainable by MSC or other agencies. In addition, 27%, or about 370,000 tons, was evaluated as “Managed.” In contrast, 15%, or about 200,000 tons was evaluated as “Needs improvement,” and 14%, or about 190,000 tons, was evaluated as “Not scored” due to insufficient data, and we recognize that these are issues requiring improvement.

Wild Capture Marine Products Categorized as “Needs Improvement”

Wild Capture Marine Products Categorized as “Not Scored”

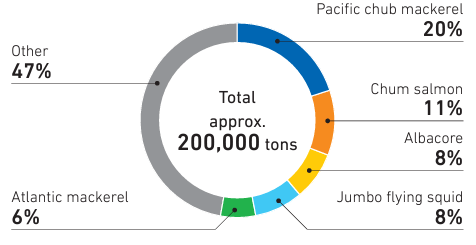

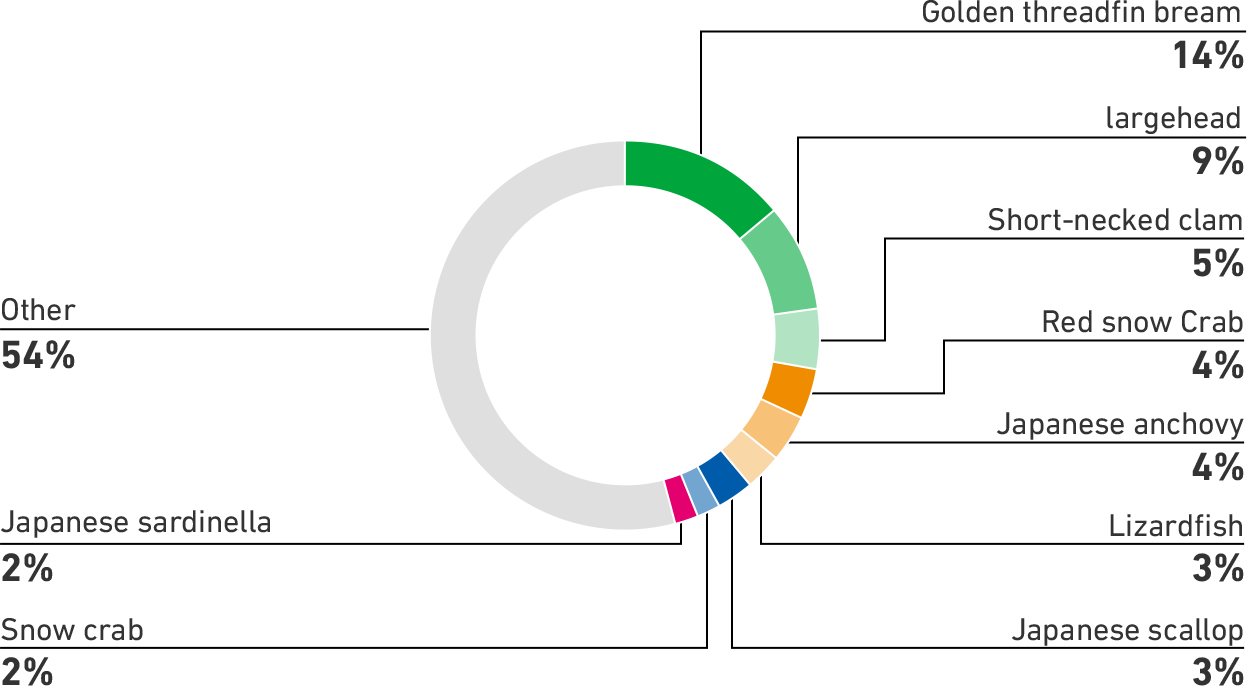

The top five species accounted for 53% of the “Needs improvement” category. Regarding fish species classified as “Not scored” due to insufficient data, such as golden threadfin bream and largehead hairtail, we will work to accurately ascertain the situation by obtaining more detailed information on the catch area and fishing method of these handled marine products.

Endangered Species

As a result of this survey, we confirmed that some of the wild capture marine handled include fish species that fall under the category of endangered species (EN) as defined by the International Union for Conservation of Nature (IUCN) (diagram below). We will continue handling fish species caught in accordance with fishery business management rules while monitoring the situation based on scientific knowledge, and discuss reviewing the handling of other fish species.

Handling of Endangered Species (As of June 2023*1)

| Red List evaluation | Species | Scientific name | Weight (t) | Country of procurement | Remarks |

|---|---|---|---|---|---|

| EN*² (Endangered species) | Southern bluefin tuna | Thunnus maccoyii | 732 | Japan, New Zealand, South Korea, Taiwan | Has resource recovery plan |

| EN (Endangered species) | Shortfin mako | Isurus oxyrinchus | 575 | China | Gradual considerations regarding handling based on viewpoint of effective use of by-products |

| EN (Endangered species) | Acadian redfish | Sebastes fasciatus | 71 | Norway, United States, Åland Islands, Japan | Consider a review of handling |

*1: Evaluation results from SFP and handling data is from FY2021

*2: IUCN (International Union for Conservation of Nature) category: Endangered (EN)

Realizing Our Ideal State in 2030

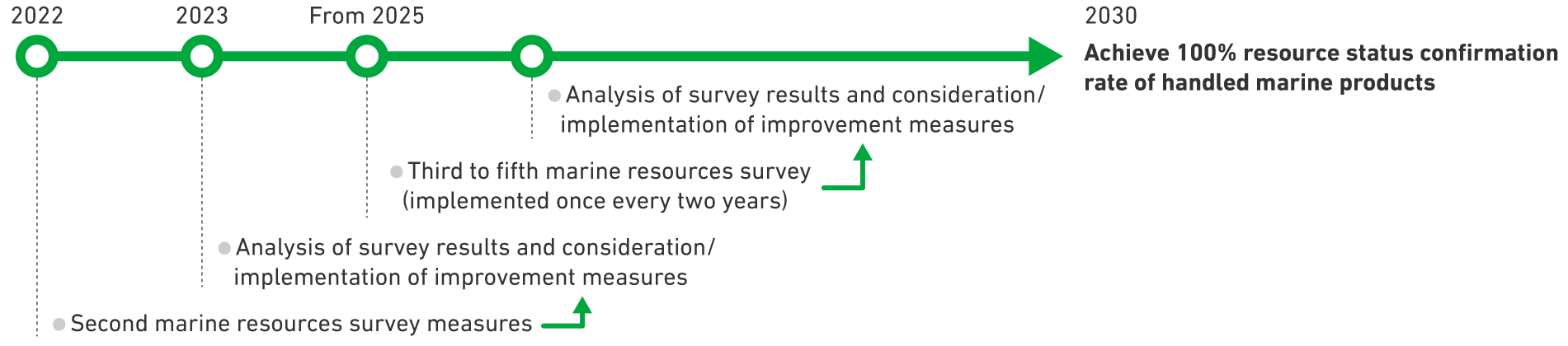

It is essential to make improvements on identified issues in order to realize our ideal state in 2030. We will promote a cycle of periodical surveys, issue identification, and improvement, with the aim of realizing our ideal state in 2030. From FY2023 to FY2024, Maruha Nichiro Corporation has been providing individual feedback on evaluation results to its business divisions and Group companies. We believe it is essential for each organization to recognize the challenges associated with the marine products they procure and to share these with our suppliers. We plan to conduct the third survey in FY2025. By regularly conducting surveys and continuously identifying and addressing challenges, we aim to achieve our ideal state for 2030.

Future Roadmap

Biodiversity Risk Assessment

Maruha Nichiro Group assessed the relationship between its business and nature based on the framework released in September 2023 by the Task Force on Nature-Related Financial Disclosures (TNFD). For more information, please visit our TNFD page.

Enhancing Access to the North American Alaska Pollock Resources

In February 2022, the Maruha Nichiro Group acquired Alaska Pollock processing facility and nine fishing vessels from Icicle Corporation of the United States to further strengthen its ability to procure sustainable marine products.

The number of rights to natural marine resources, such as fishing quotas, is limited worldwide, and new acquisitions can be quite difficult. The addition of the access share will strengthen access to the Bering Sea, a vast area with abundant and sustainable Alaska Pollock stocks. Specifically, we have gained an approximately 27% share of the total Bering Sea quota for Alaska Pollock (the quota generally available to companies, excluding the quota given to natives). In addition, Alaska Pollock is reported to be a climate-friendly protein compared to other proteins. As a sustainable protein, demand is strong worldwide in terms of population growth and health consciousness, but we will be able to better meet the needs of general consumers in various forms such as fillets and surimi.

For details, click here. (PDF: 883 KB/ 9 pages)

Implementation of Certification-Level Management for Aquaculture Farms

In order to put the materiality of “action for preserving biodiversity and ecosystems” into practice for the Group’s aquaculture business, we conducted a gap survey that uses the ASC yellowtail/cobia standards as its benchmark at the business sites of Maruha Nichiro Marine Kumano and Maruha Nichiro AQUA Sakurajima in FY2022. We formulated our proprietary voluntary management standards in FY2023 based on the survey results and conducted audits at four fishing grounds to ensure compliance with the standards and to identify issues. We plan to conduct audits at the remaining nine fishing grounds in FY2024 and complete audits of all the fishing grounds in our Aquaculture Business Unit. We will continue to make improvements based on the results of these audits in order to practice sustainable aquaculture with a reduced impact on the environment.

Activities for Obtaining Sustainable Aquaculture Certification (ASC Certification) for Greater Amberjack and Yellowtail

Maruha Nichiro Corporation AQUA Kuneze fishery became the first company in the world to receive ASC certification for greater amberjack aquaculture in July 2019 and full-scale shipments began in May 2020.

Maruha Nichiro Corporation AQUA Kamiura fishery obtained ASC certification for yellowtail aquaculture in April 2018, and full-scale shipments began in February 2019.

We will continue to deliver to customers through an integrated value chain that encompasses catch, live transport, fillet processing at specified plants contracted by Maruha Nichiro, and sale through mass retailers.

Note: On Friday, April 1, 2022, the six Group Companies engaged in the aquaculture operations were merged into two companies, Maruha Nichiro AQUA Co., Ltd. and Maruha Nichiro Marine Co., Ltd. Maruha Nichiro AQUA (Head Office: Kagoshima City, Kagoshima Prefecture) integrated four companies in the Kyushu region, Sakurajima Yougyo Co., Ltd., Amami Yougyo Inc., Aquafarm Co., Ltd., and Genkai Co., Ltd. while Maruha Nichiro Marine Co., Ltd. (Head Office in Kushimoto, Wakayama Prefecture) integrated two companies in the Kishu region, Kushimoto Marinefarm Co., Ltd. and Kumano Yougyo.

Toward Mainstreaming Sustainable Seafood

As part of our materiality “Providing food that contributes to the creation of health value and sustainability,” we have set “establishing a brand as a top food company that contributes to the creation of health value and sustainability” as our ideal state in 2030. To achieve this goal, we are promoting various initiatives under the name of “KENPRO” within the company. Through the activities of KENPRO, we will actively play a leading role in the industry toward the mainstreaming of sustainable marine products. For more information, please visit the KENPRO page.

Health Value Creation (KENPRO)

Electronic Traceability of Fishery Products

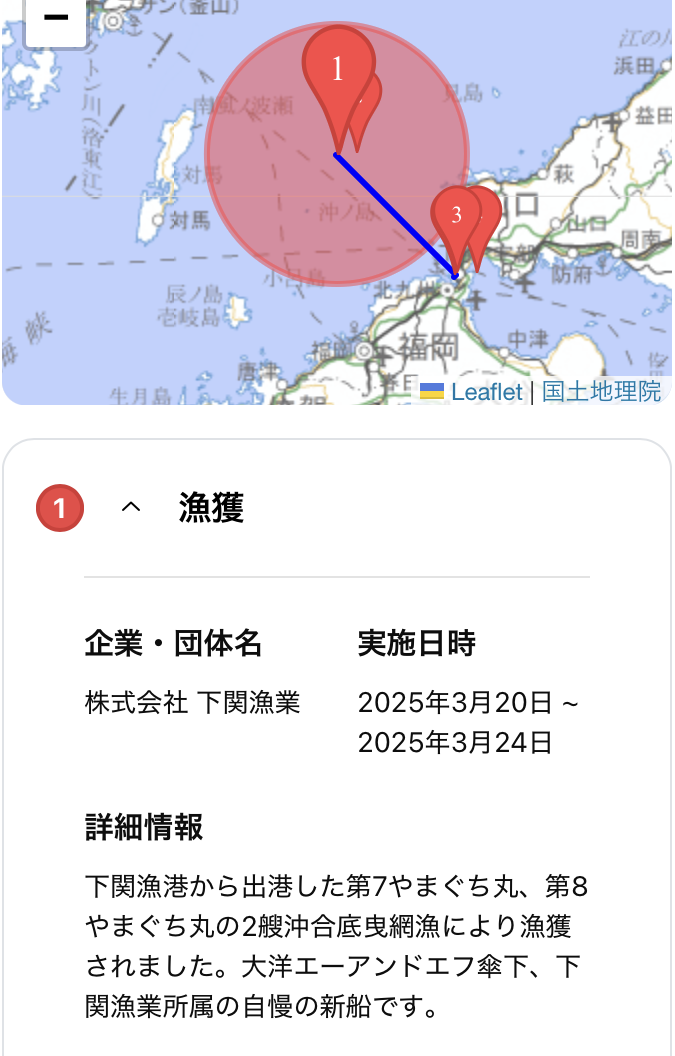

We are promoting efforts to digitalize traceability in the distribution of marine products. In line with the KPIs set forth in the new medium-term management plan, we aim to begin operation of this system for some fish species by FY2027. As part of this initiative, we conducted the first demonstration experiment from April to May 2025 in collaboration with group fishery companies, intermediate wholesalers, and IT companies. We will accelerate our efforts through co-creation with various stakeholders to drive full chain traceability in the industry.

*Display company name, date and time, and fishing vessel information related to the catch.

Efforts to Combat IUU Fishing and Lobby for Institutional Reform

In the new medium-term management plan, we have newly set the establishment of a method to avoid procurement from the IUU fishing industry and the promotion of lobbying activities as KPIs. In addition to working to establish auditing methods for high-risk suppliers with a focus on IUU fishing, we will promote efforts to resolve the IUU fishing problem by reaching out to various quarters based on the recognition that systemic reform involving the entire industry is necessary to address issues that are beyond our ability to address on our own.

Other Initiatives

Case Study: Activities Related to Sustainable Aquaculture Operations (PDF: 490 KB/4 pages)

Case Study: Joint Research Aimed at Establishing Fish Cell Culture Technology (PDF: 267 KB/1 page)