The Maruha Nichiro Group strives to achieve sustainable growth and implement improvements in corporate values focusing on the long term by building equitable and productive relationships with our stakeholders. To this end, we place importance on ensuring operational integrity, transparency and efficiency while working to enhance corporate governance utilizing measures to accelerate decision making and strengthen oversight.

Corporate Governance Framework

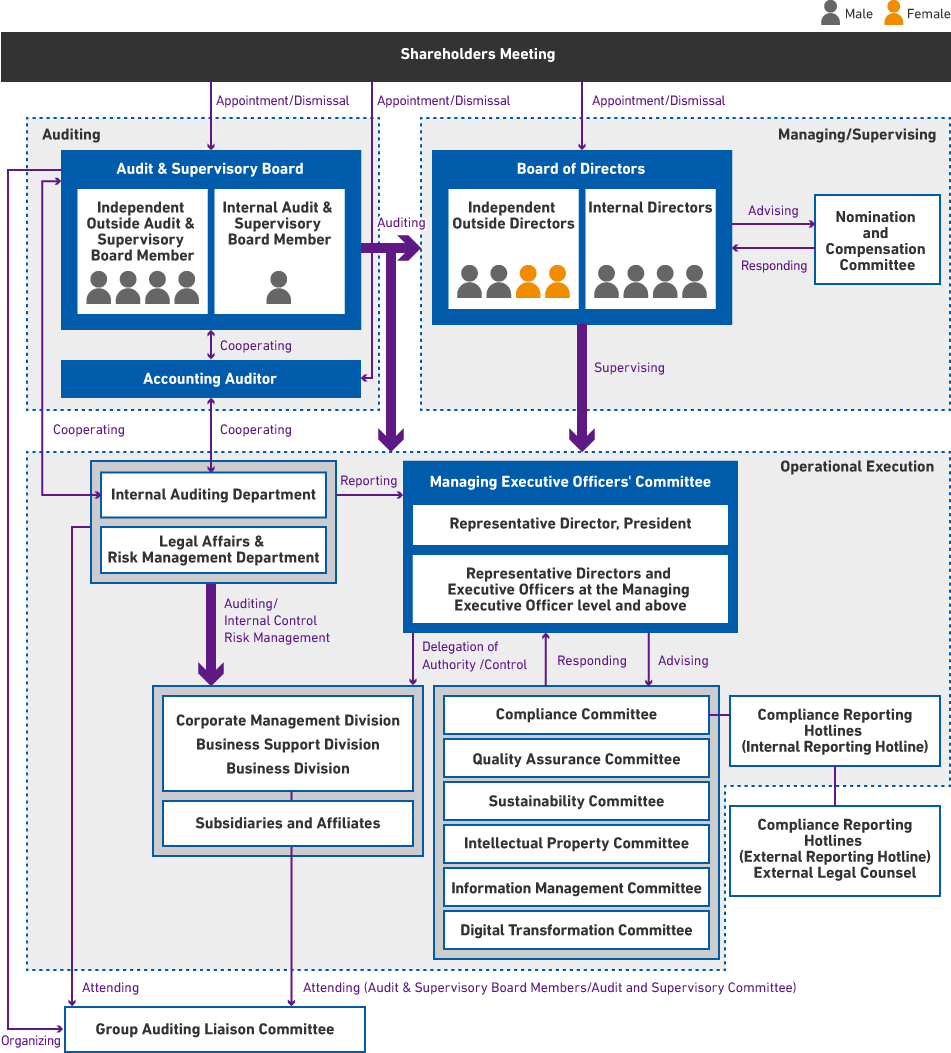

Maruha Nichiro Corporation has adopted a corporate auditing system recognizing that having Audit & Supervisory Board members supervise the execution of duties by directors as an independent institution consigned by shareholders represents an effective means for securing the sound and sustainable growth of the company and strengthening our high-quality corporate governance framework in response to social credibility.

Corporate Governance Framework

(As of June 25, 2024)

Overview of the Corporate Governance Structure

- Corporate Governance System

- Audit and Supervisory Committee

- Directors

- 11 (Of whom 6 are Outside Directors)

- Chairperson of the Board of Directors

- President

- Term of office for Directors

- One year

- Adoption of Executive Officer System

- Yes

- Advisory Committees to the Board of Directors

- Nomination and Compensation Committee

- Independent External Auditor

- KPMG AZSA LLC

(As of June 25, 2025)

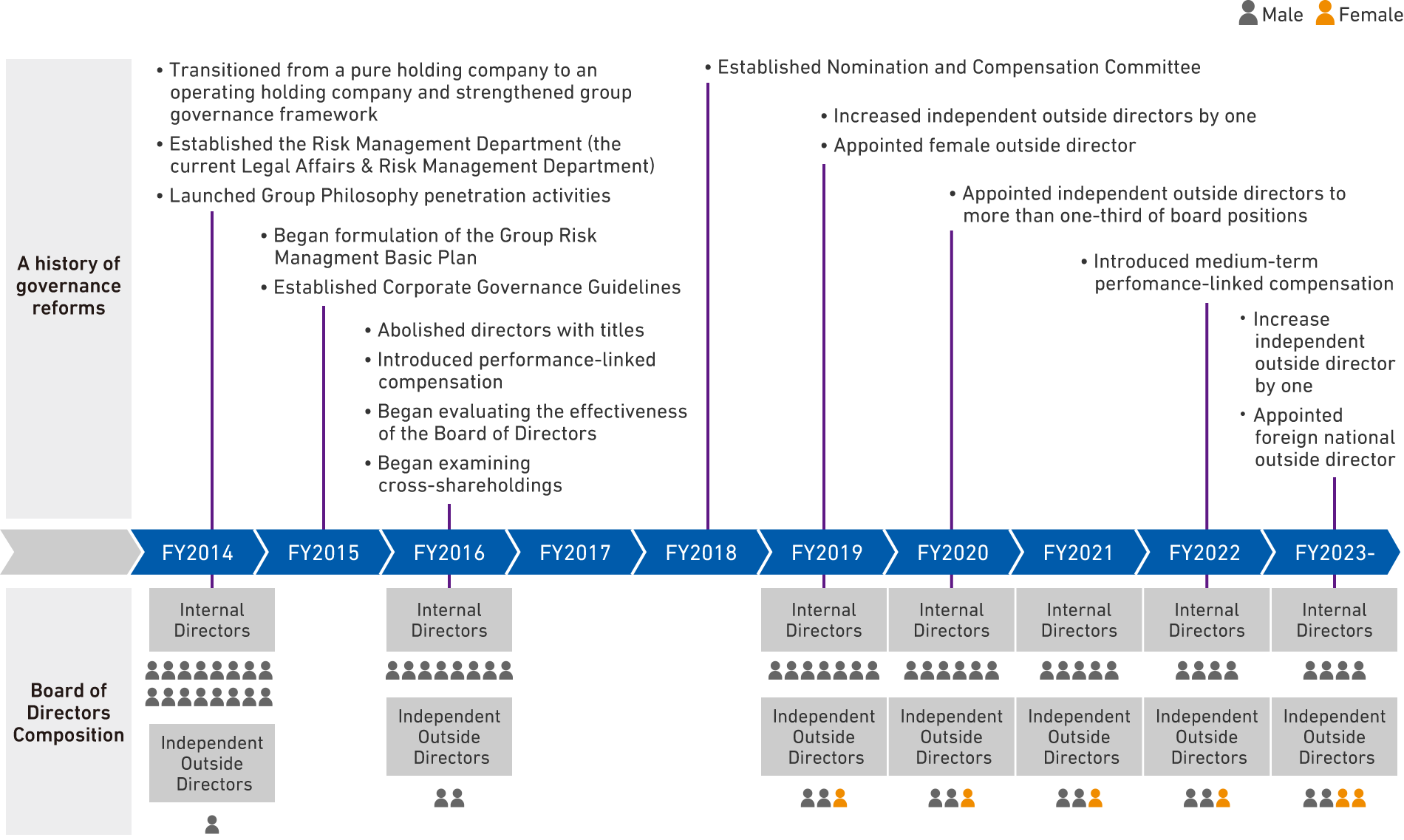

History of Recent Governance Reforms

* Board of Directors composition for the FY2022: One internal director resigned during the fiscal year.

* Board of Directors composition for the FY2023: Four internal directors and four independent outside directors (including two female directors) as of June 27, 2023.

Board of Directors

The Board of Directors has introduced an Executive Officer system to clearly separate and appropriately allocate responsibilities for supervision and execution in coordination with the Managing Executive Officers’ Committee. The Board supervises business execution from an objective standpoint. In principle, Board meetings are held once a month to make decisions on key management matters such as management policies and strategies, the Mid-term Management Plan, the annual management plan, and capital policy. Decisions on individual business execution are delegated to the Managing Executive Officers’ Committee.

In the Fiscal Year ended March 2025, the Board of Directors met 16 times, including extraordinary meetings. The average attendance rate was 100% for directors and 98% for Audit & Supervisory Board members.

Audit & Supervisory Committee

The Audit and Supervisory Committee, established on June 25, 2025, is composed of three members, including two Outside Directors. In accordance with the Audit and Supervisory Committee Regulations and other related internal rules, the Committee monitors, supervises, and audits the legality and appropriateness of the execution of duties by Directors.

Nomination and Compensation Committee

In the Fiscal Year ended March 2025, the Nomination and Compensation Committee met six times, with an average attendance rate of 100% among its members.

Managing Executive Officer's Committee

The Managing Executive Officers’ Committee is composed of seven members, including the Representative Director and Executive Officers at the Managing Executive Officer level or above. In principle, the Committee meets once a week to make prompt management decisions on matters delegated by the Board of Directors, and reports important matters to the Board.

Other Committees

As advisory bodies to the Managing Executive Officers’ Committee, the following committees have been established, each led by a chairperson appointed by the Committee. Directors participate in these committees either as members or observers.

Advisory Body to the Managing Executive Officers' Committee

| Committee Name | Committee Chair / Chairperson | Role of Committee |

|---|---|---|

| Investment Council | Managing Executive Officer | Deliberates on matters related to investment and other proposals promptly and accurately from a broad perspective based on expert knowledge and contributes to rational decision-making based on risk analysis and evaluation |

| Compliance Committee | Director, Managing Executive Officer | Prevention and early detection of violations of laws and regulations within the Group, as well as spreading awareness of compliance with laws and regulations |

| Quality Assurance Committee | Director, Senior Managing Executive Officer | Formulates quality assurance policies for the Group, develop strategies and plans for quality assurance, and promote and manage the progress of activities related to quality assurance |

| Sustainability Committee | Managing Executive Officer | Plans and implements the Group's sustainability strategies and activities, and progress management of initiatives for each materiality |

| Intellectual Property Committee | Director, Managing Executive Officer | Plans the Group's intellectual property strategy, as well as protecting and expanding the intellectual property of the core business |

| Information Management Committee | Director, Managing Executive Officer | Appropriately manages personal and confidential information, regardless of the form in which it is used, to address significant management risks related to information. |

| Product Development Committee | Director, Senior Managing Executive Officer | Approves policies and strategies for product development, gives final approval of new product launches, and establishes and operates systems related to product development |

| DX Promotion Committee | Managing Executive Officer | Promotes DX infrastructure design, innovation, and digital technology through the consolidation and promotion of DX-related information |

| Human Rights Awareness Promotion Committee | Director, Senior Managing Executive Officer | Conducts human rights education and awareness programs in the Group to deepen correct understanding and awareness of various human rights issues and to build a corporate culture of respect for human rights that does not tolerate discrimination |

Main Deliberations by the Board of Directors (FY2024)

- Review of Cross-shareholdings:

-Future course of action for each stock discussed by the Executives. - Introduction of a Stock Benefit Plan for Employees:

-Appropriateness of the performance-linked coefficients

-Plans to expand coverage to a broader group of employees. - Dividend Policy:

-Enhancing opportunities for shareholder returns.

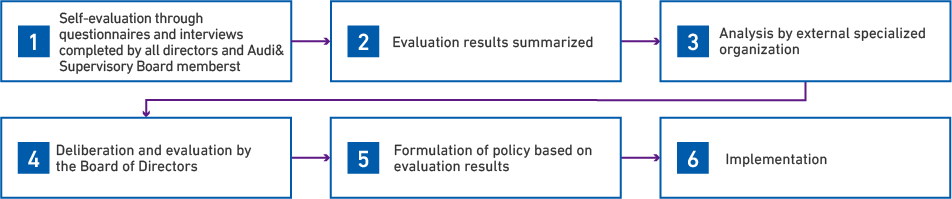

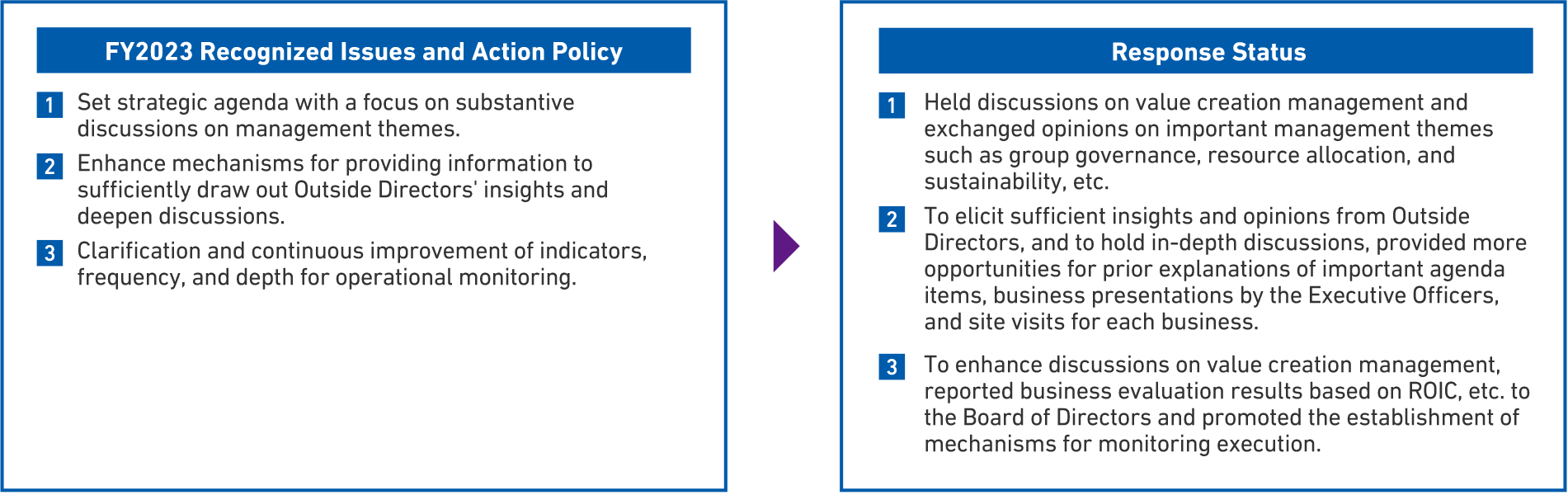

Evaluation of Board of Directors' Effectiveness

Once every year, Maruha Nichiro Corporation conducts a self-evaluation of its Board of Directors by each director as stipulated in Article 21 of the Corporate Governance Guidelines to analyze and evaluate the board's effectiveness, and discloses the summary of the results. In FY2024, the Board of Directors deliberated on the results of the evaluation based on self-assessment in the form of a questionnaire and interview with all Directors and all Audit & Supervisory Board Members conducted from February to April, and an analysis was conducted with the support of an external specialized organization. The Board of Directors is functioning appropriately, and its effectiveness is ensured.

Effectiveness Evaluation Process

Evaluation Items

Analysis and Evaluation of Board of Directors' Effectiveness

Looking Ahead

Independence Criteria for Outside Officers

Maruha Nichiro Corporation deems an outside officer independent if the following conditions do not apply.

- Operational execution person of a major business partner of the Group. A major business partner is a business partner whose transaction amount exceeds 2% of the consolidated net sales of the Group or the business partner (including its parent company and major subsidiaries).

- Operational Execution person of the Group's major lender. Major lenders are lenders who have financed the Group in excess of 2% of the Company's consolidated total assets at the end of the most recent fiscal year.

- Lawyer, certified accountant, tax accountant or consultant receiving monetary or financial benefits in excess of 10 million yen a year from the Company in addition to compensation as director

- Person or Operational Execution person who received donations or subsidies from the Company in excess of 10 million yen a year

- A person who fell under (a) to (d) above within the past 2 years

- If the person who falls under (a) to (d) above is an Operational Execution person, including Director, Executive Officer, or General Manager level or higher, or an operational executor with equivalent authority, the spouse or a blood relative within the second degree kinship of the above.

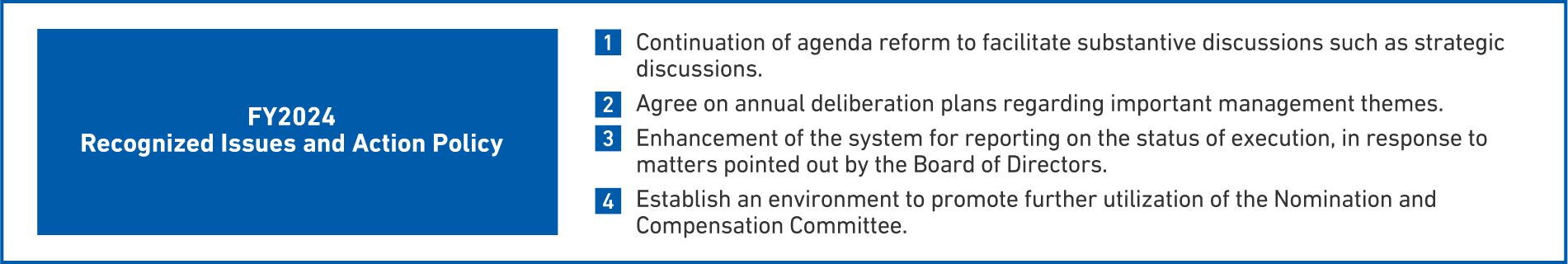

Approach to the Executive Compensation System

Regarding the compensation of management and Directors (excluding Directors who are Audit and Supervisory Committee members), it consists of (i) fixed remuneration, (ii) short-term performance-linked compensation, and (iii) medium-term performance-linked stock-based compensation. Outside Directors receive only fixed remuneration.

The Company has established a Nomination and Compensation Committee as an advisory body to the Board of Directors. This committee deliberates on the compensation system and levels, and decisions are made by resolution of the Board of Directors.

Executive Compensation System

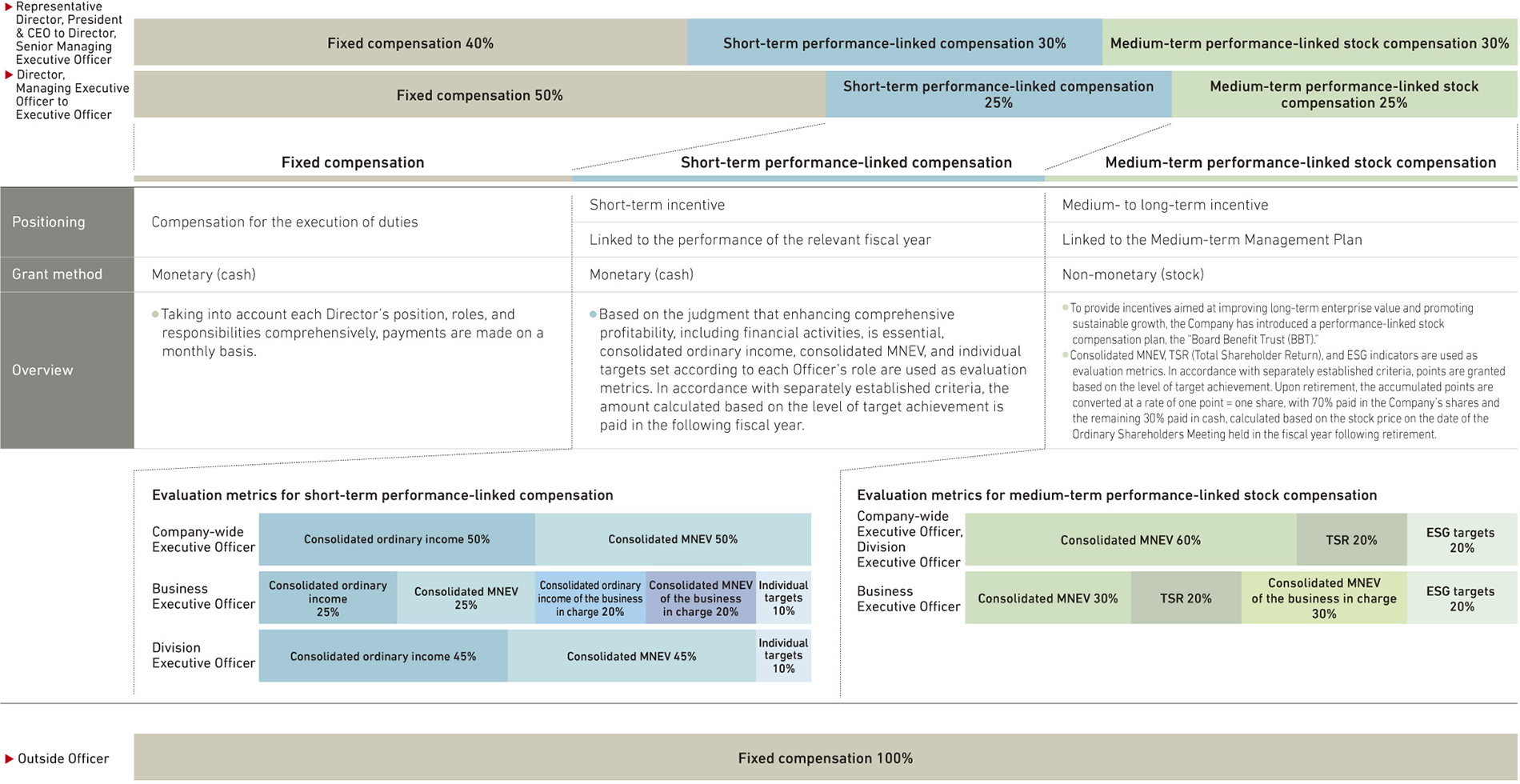

Illustration of Performance-linked Stock Compensation Plan

- After receiving approval of the Plan at the General Meetings of Shareholders, the Company will establish a “Directors' Stock Benefit Regulations” within the framework approved at the General Meetings of Shareholders.

- The Company will place money in trust within the scope approved by resolution of the General Meetings of Shareholders.

- The Trust will acquire Company shares using the money entrusted in 2 above, as the source of funds, either through the stock exchange or by accepting the disposal of Company treasury stock.

- The Company will grant points to directors, etc. based on the “Directors' Stock Benefit Regulations”.

- The Trust shall not exercise voting rights pertaining to Company shares in the Trust account in accordance with the instructions of the Trust administrator, who shall be independent from the Company.

- The Trust shall deliver Company shares to those Eligible Directors who meet the requirements as beneficiaries as provided in the “Directors' Stock Benefit Regulations”, in proportion to the number of points granted to said Beneficiaries. However, if the Eligible Directors meet the requirements as provided in “Directors' Stock Benefit Regulations”, such Eligible Directors shall be granted payment in the equivalent of Company shares at market value according to an established proportion of points.

Approach to Cross-shareholdings

As a basic policy, the Company holds shares of business partners as strategic equity investments when it judges that such holdings contribute to the Group’s medium- to long-term corporate value enhancement.

The Board of Directors conducts an annual review of the investment value of each cross-shareholding. For stocks where the Company no longer recognizes the significance or rationality of continued ownership, the Company takes steps to reduce holdings, such as through sales, while engaging in dialogue with the investee, considering stock prices and market trends.

As of the Fiscal Year ended March 2025, the ratio of policy-held stocks to net assets was 9.96%, a decrease of 4.76 percentage points compared to the previous year.

Approach to Group Governance

Maruha Nichiro Corporation has established the Maruha Nichiro Group Risk Management Regulations, and has been conducting annual risk surveys to identify and evaluate risks among each division and Group company since FY2015. We also formulate the Risk Management Basic Plan. Details of these activities are reported to the Board of Directors, and risk information across the entire group is shared.

Engagement with Shareholders

Details of Shareholder Dialogue and Engagement for the Fiscal Year Ended March 2025 (April 2024- March 2025)